The Revolut Story: A Decade of Compounding

… with many more decades to follow

I’ve been studying Revolut for years, invested earlier this year, and the story just keeps getting better. A decade in, it feels like they’re just getting started.

How It Started

In the mid-2010s, consumer banking was on the verge of a transformation. Smartphones had become ubiquitous, trust in traditional banks was shaky post-2008, and a new wave of “neobanks” and fintech startups emerged to reimagine banking for the digital age. The neobank thesis was elegantly simple: traditional banks had terrible apps, charged hidden fees, and moved at the speed of bureaucracy. A new generation of mobile-first challengers could do better.

Around 2015, the starting gun fired almost simultaneously across Europe. N26 launched in Berlin. Monzo and Starling emerged in London. Chime started acquiring users in San Francisco. TransferWise (now Wise) tackled cross-border transfers. Each had its own wedge. Monzo built a social, mobile-first checking account. Chime partnered with banks to offer fee-free accounts with early wage access. N26 focused on elegant European design. TransferWise made international transfers cheap. The fintech playbook was evolving rapidly, but most players were betting on winning one market or one product category at a time.

Revolut entered this crowded field in July 2015 with a different thesis entirely. Revolut’s founding insight was that banking could be approached like a global software product, full-stack and borderless from day one. Nikolay Storonsky (ex-Lehman, Credit Suisse) and Vlad Yatsenko launched with a simple mobile app linked to a prepaid card for travelers. The card let users hold multiple currencies and get interbank FX rates, a radical convenience compared to banks quietly extracting 2-3% on foreign transactions.

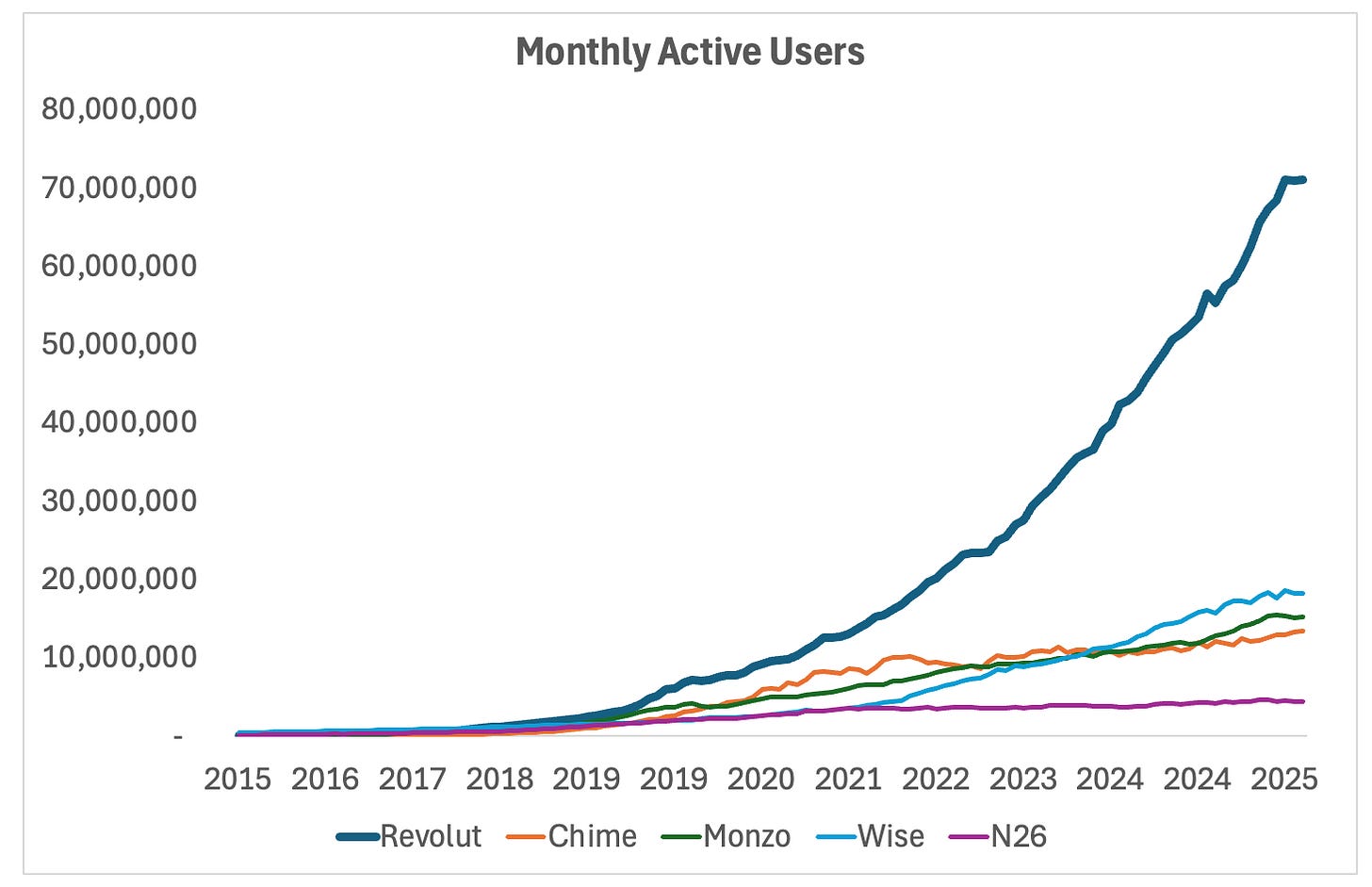

Fast forward to today, Revolut has pulled away from its peer group with a staggering 65M customers globally.

Why Revolut Broke Out

The typical fintech advice was to win one market or one product category at a time. Revolut decided to do both from the very early days, simultaneously adding new products each year while entering new countries. This was bold and controversial. But it worked.

Speed as strategy. Culturally, the team became known for lightning-fast execution and relentless product launches. Storonsky’s view: shipping faster and iterating more gives you more chances to win. Within a few years, Revolut rolled out not just spending and FX, but crypto trading (2017), stock trading, savings vaults, budgeting tools, insurance, P2P payments, business accounts, and more, effectively molding itself into a financial super-app while competitors stuck to narrower playbooks.

Full-stack ownership. While competitors built on banking-as-a-service partners or relied on middleware, Revolut invested obsessively in proprietary infrastructure. They now hold dozens of regulatory licenses globally. When you control the stack, you control the user experience, you can ship faster, and you can enter new markets without renegotiating with partners.

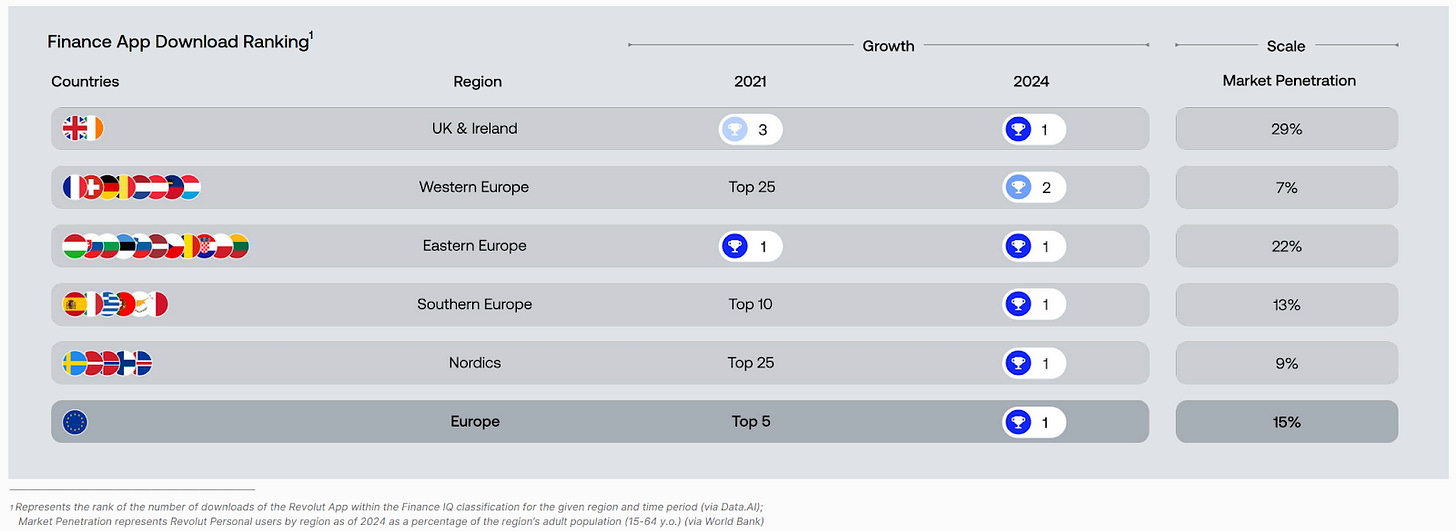

Geographic ambition with geographic capability. Many fintechs “launch” internationally but Revolut actually wins markets. Monzo’s US expansion stalled. N26 withdrew from the UK entirely post-Brexit. Chime stayed US-only. Revolut now operates in 48 countries and is the #1 finance app by downloads in over a dozen EU countries.

Revenue Diversification —> Business Resilience

Here’s what I find most compelling about Revolut’s model: the revenue diversification.

Most fintechs have significant concentration on one business model. Nubank derives ~85% of revenue from lending. Chime is ~70% interchange. Stripe is 90%+ payments. Ramp is ~90% interchange. When your dominant revenue stream faces headwinds, such as regulatory caps, rate changes, competitive pressure, the whole business feels it.

Revolut has built something structurally different. They now have 8+ revenue streams:

Card payments and interchange

Subscriptions (Plus, Premium, Metal, Ultra tiers)

Foreign exchange and cross-border transfers

Wealth products (stocks, crypto, commodities, money market funds)

Credit (personal loans and credit cards)

Business accounts and B2B services

Merchant acquiring (Revolut Pay)

Net interest income on deposits

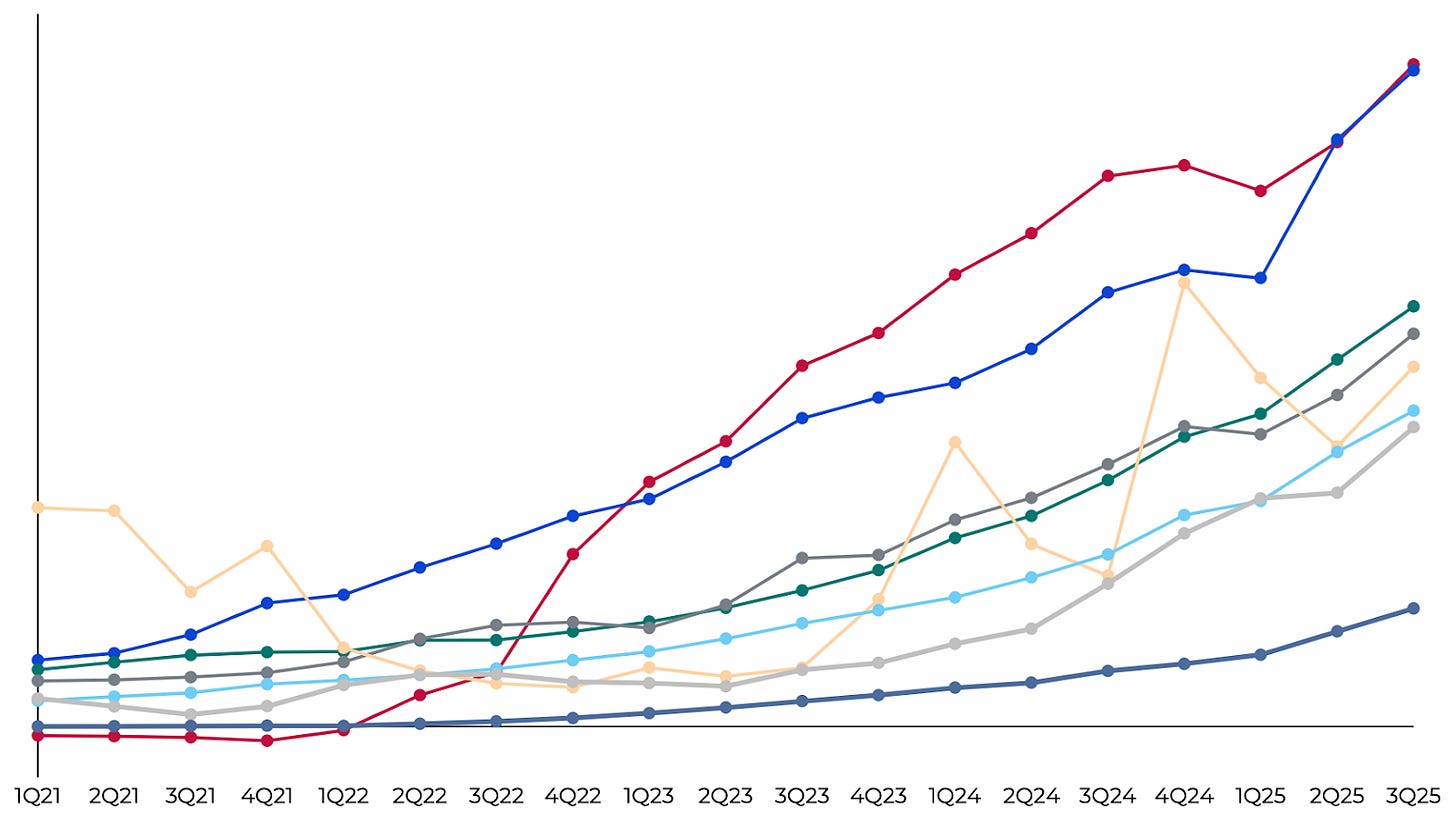

No single product or segment accounts for more than ~30% of revenue. The value is resilience. When crypto volumes crashed, subscriptions kept growing. When interchange gets squeezed by regulation, credit products scale. When rates eventually fall, payments and FX compensate. The diversification smooths cyclicality and creates more durable compounding than single-product businesses can achieve.

It also means Revolut’s marginal economics improve with scale. Many of these revenue streams are pure software margins, subscriptions, trading fees, FX spreads. Each incremental customer adds revenue at low marginal cost. Coupled with disciplined cost control, this is why they’re running 25%+ net margins at scale.

Revolut quarterly revenue across segments:

Thinking In Bets

What makes Revolut’s diversification sustainable is how they think about new products.

The company runs itself like a portfolio of venture-like businesses inside the firm. Dozens of bets outside the core business lines are active at any time. Only a fraction of them will graduate to real business lines. And there are dozens more in the hopper that haven’t even started pilots yet. This is a fundamentally different operating model than most financial services companies. Traditional banks committee-approve three-year product roadmaps. Revolut runs experiments, measures ruthlessly, kills what doesn’t work, and doubles down on what does.

The 8+ revenue streams didn’t emerge from a strategic planning exercise. They emerged from this bets culture, crypto trading started as a bet in 2017, business accounts started as a bet, credit started as a bet. The ones that worked became real businesses. The ones that didn’t got killed quickly. It’s the same logic that venture portfolios use: accept that most experiments won’t work, but make sure you’re running enough of them that the winners more than compensate.

What makes Revolut interesting today isn’t just past execution, it’s the optionality in their current portfolio. A few emerging growth levers that stand out are 1) Credit: still nascent but growing fast. They’re live with credit products in 9 countries and have signaled mortgages are on the roadmap. Credit is high-margin but high-risk; if they execute here without blowing up on losses, it transforms the unit economics further. 2) Business banking is working. Revolut now has a remarkable B2B franchise built on top of the consumer platform. 3) Geographic expansion continues. They’re now pursuing licenses in Brazil, India, Mexico, Colombia, and across Asia-Pacific. Their “mature” European markets have 40+ million users serving ~560 million population. Expansion markets represent billions more.

The stated goal is audacious: 100 countries by 2040. A truly global digital bank. If the last decade is any indication, they’ll get there.

A decade in, the compounding is just getting started.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.