Why Meta & Google may win Consumer AI, before ChatGPT does

Consumer AI at crossroads

Contents:

Engagement: How Entrenched Are Users?

Retention: ChatGPT starts to smile!

Time Spent: Attention is not all you need!

Putting it all together

In the AI gold rush, with trillions poured into capex and sky-high valuations, ChatGPT has emerged as the killer AI app, practically a household name today. However, will it be the most adopted AI app by the end of the decade?

My analysis reveals a twist. Unless OpenAI radically evolves, the dark horses (Meta and Google) are poised to dominate consumer AI by decade's end.

Forget the hype. Ignore the flashy demos. Real-world adoption and usage tell the true story of AI's future. As the former Product Manager at Palantir, I've learned to trust product metrics. I dissect a panel of usage metrics for Gen AI apps versus best-in-class consumer and enterprise apps. The results?

Take ChatGPT. Its weekly-to-monthly active user ratio (a measure of engagement) is 40%. Impressive for a newcomer, but a far cry from the 80% mark of billion-user apps. Meanwhile, Meta and Google's suite - Instagram, WhatsApp, Gmail, Chrome - have sky-high engagement and massive user bases. These aren't just apps. They're digital empires, primed for AI domination.

In this deep dive, we'll explore AI's true potential through concrete, quantifiable metrics. For entrepreneurs and investors eyeing the AI prize, consider this your reality check. The AI race isn't just about demos, it’ll be about user adoption, engagement, and stickiness. And in that game, the tech giants already have a massive head start.

#1 Engagement: How Entrenched Are Your Users?

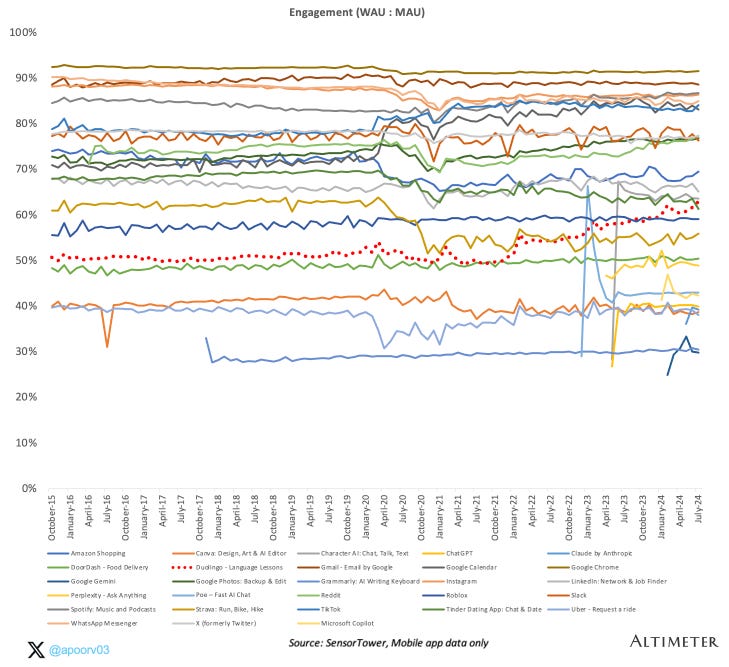

Engagement metrics reveal how deeply an app is integrated into users' lives -- a critical indicator of long-term success and growth potential. While DAU:MAU (Daily Active Users to Monthly Active Users) is the go-to metric for consumer applications, I use a modified version: WAU:MAU (Weekly Active Users to MAUs). This metric better aligns with the work week, accommodates intensive but sporadic use of AI apps within knowledge work, and enables fairer comparison with enterprise software applications.

High WAU:MAU ratios signal that users find consistent value week after week -- crucial for products aiming to become indispensable tools. When we look at the data, a striking pattern emerges:

This chart plots MAU (y-axis) against Engagement (WAU:MAU on x-axis). Takeaways:

The Billion-User Threshold: Apps need to achieve 80%+ WAU:MAU to reach a billion users. This exclusive club includes Instagram, WhatsApp, GMail, GCalendar, and Chrome -- all owned by Meta and Google.

Enterprise apps: Enterprise apps like Outlook, Teams, and Slack form the next tier at 60-70% engagement.

AI's Current Standing: Most Gen AI apps, including ChatGPT, hover around 40-50% engagement -- significantly behind both consumer and enterprise leaders. The notable exception is Character AI, which has broken out of this range.

The Character AI Exception: Notably, Character AI (recently acquired by Google) shows higher engagement, breaking out of the typical Gen AI cluster.

Meta + Google’s Distribution Advantage: Meta owns two of the most engaging, billion-user apps (Instagram and WhatsApp), while Google dominates with Chrome and Gmail. This positions both companies strongly for AI integration and workflows that let users access AI from within this existing real esatate.

So how can ChatGPT get to a billion users?

Data suggests that for ChatGPT or any AI app to reach billion-user status, it needs to dramatically increase their WAU:MAU ratio to 80%+. However, historical data shows this is a formidable challenging because WAU:MAU ratios stay remarkably stable over time. See chart:

In this chart above, only Duolingo and Google Calendar show significant improvements over a decade, and even these are modest (dotted lines). This stability implies that an app's engagement level is largely determined by its category and core value proposition, not easily altered by feature additions or marketing efforts.

Implications for Consumer AI:

ChatGPT's Uphill Battle: To reach a billion users, ChatGPT needs to more than double its current engagement levels - a feat rarely achieved in tech history.

Meta's Edge: With Instagram and WhatsApp already in the billion-user, high-engagement quadrant, Meta has a significant head start in deploying AI to a massive, engaged user base.

Google's Dual Strategy:

High-Engagement Products: Google can leverage its highly engaged user base in Chrome and Gmail to introduce AI features.

AI Specialization: The acquisition of Character AI, combined with their own Gemini, gives Google both a well-engaged AI product and the potential to improve their lower-engaged offering.

The Integration Advantage: Rather than standalone AI apps, the future might belong to AI deeply integrated into existing high-engagement platforms - a scenario that favors established tech giants like Meta and Google.

This data suggests that the race for AI dominance may not be won by AI-first companies alone, but by those who can most effectively integrate AI into already-indispensable applications, especially those with network effects. The established tech giants, with their massive, highly-engaged user bases, appear to have a significant advantage in this regard.

#2 Retention: ChatGPT starts to smile!

While engagement metrics show how often users interact with an app, retention reveals whether they find lasting value. Let's examine how AI apps compare to established enterprise and consumer applications in terms of retention.

This chart comparing 1-month retention rates reveals some intriguing patterns:

Big Tech Dominates Consumer: Meta and Google's consumer apps lead the pack. WhatsApp (90%), Instagram (90%), and Chrome (89%) show impressive Month 1 retention rates, underlining these tech giants' ability to create sticky products.

Enterprise Apps Steady: Google's Gmail (75%) maintains a solid retention rate, outperforming many other enterprise tools.

AI Apps Show Promise: Gen AI apps are performing relatively well, with ChatGPT (66%) showing retention rates comparable to some enterprise apps. This is particularly impressive given its novelty.

The Gap Persists: While promising, Gen AI apps still lag behind the best consumer apps in retention, mirroring what we saw with engagement metrics.

However, the story doesn't end with first-month retention. Let's look at how retention trends over time. But first a primer of what to expect in retention curves. There are three kinds of retention curves: smiling, flattening, declining.

Sequoia does a good breakdown on these:

Flattening: Suggests a core group of users found ongoing value.

Declining: Indicates continuous user loss over time.

Smiling: Rare and highly desirable, showing users returning after initially churning.

Analyzing retention from Month 0 to Month 10 reveals some fascinating insights:

Google's Dominance: Chrome and Gmail (both Google properties) display rare and valuable "smiling" retention curves, indicating increasing value to users over time.

Meta's Strong Performance: WhatsApp and Instagram show exceptionally stable, high retention curves, demonstrating Meta's ability to create lasting user value.

ChatGPT's Surprising Trend: Intriguingly, ChatGPT is the third app in our dataset showing a "smiling" curve. While not as pronounced as Google's apps, this trend suggests ChatGPT is providing increasing value to its users over time.

The AI Challenge: Most other AI apps show steeper drops in retention, highlighting the difficulty of maintaining a user base in this competitive space.

Implications for the Consumer AI Race:

Google and Meta's Advantage: With multiple products showing industry-leading retention, these tech giants have a solid foundation for introducing and scaling AI features to a loyal user base.

ChatGPT's Potential: The "smiling" retention curve for ChatGPT is a positive sign, indicating it might be on a path to creating lasting user value. However, it still has ground to cover to match the retention levels of top consumer apps.

Integration vs. Standalone: The strong retention of existing popular apps from Google and Meta suggests that integrating AI into these platforms could be more effective than creating standalone AI apps.

The Long Game: While AI-first companies like OpenAI (with ChatGPT) show promise, the consistently high retention of Meta and Google's products underscores the challenge they face in creating habitual, long-term use.

In conclusion, retention data further supports the notion that tech giants like Meta and Google are well-positioned to dominate consumer AI. Their existing products already demonstrate the ability to create lasting user value – a crucial factor in the AI race. However, ChatGPT's positive retention trend suggests that AI-first companies shouldn't be counted out just yet. The key to success may lie in bridging the gap between promising technology and ingrained user habits.

#3 Time Spent: Attention is not all you need

After examining engagement and retention, let's look at another crucial metric: time spent. This metric gives us insight into how deeply users are engaging with these apps and the potential for monetization.

Takeaways:

Social Media Dominance: TikTok leads, with Meta's apps (Instagram, Facebook) also showing strong performance.

Google's Ecosystem: While not topping the chart, Google's suite (YouTube, Chrome, Gmail) collectively captures significant user time.

AI Apps' Promise: Character AI (now owned by Google) stands out among AI apps, with usage times comparable to some social media platforms.

ChatGPT's Position: Shows respectable time spent, considering its utility focus versus entertainment-centric apps. It’s also showing some improvement over time up ~100% y/y from 13 mins / week to 26.

It's crucial to note that time spent metrics are heavily influenced by business models:

Ad-based models (like social media platforms) naturally incentivize more time spent.

Paid or transactional apps often focus on efficiently completing tasks or transactions, potentially resulting in less time spent.

Implications for Consumer AI:

Meta and Google's Advantage: Their apps already command significant user time, providing a captive audience for AI feature integration.

Integration Potential: Incorporating AI into existing, heavily-used apps may be more effective than standalone AI applications in capturing sustained attention.

AI-First Challenge: Companies like OpenAI must create compelling experiences that carve out time in users' busy digital lives.

Business Model Considerations: As AI apps evolve, their approach to monetization will likely influence design choices that impact time spent metrics.

The time spent data reinforces Meta and Google's potential advantage in consumer AI. Their existing apps not only boast high engagement and retention but also command a significant share of users' digital time. This provides ample opportunities to introduce AI features within contexts where users already spend considerable time.

For AI-first companies, the path to widespread adoption may require either exceptional standalone experiences or strategic partnerships with platforms that already capture significant user attention.

#4 Putting it all together

The data suggests Meta and Google are strongly positioned to lead in consumer AI, potentially outpacing current AI-first leaders and even ChatGPT - the killer app.

Why? It's simple:

Engagement: Their apps are already daily habits for billions.

Retention: Users stick around, providing continuous data and opportunities.

Time Share: They own the lion's share of our digital attention.

Distribution: Unparalleled ability to deploy AI features at scale.

Network Effects: Massive user bases accelerate AI improvement.

Meta's secret weapon? Zuckerberg's "move fast and copy" ethos. His track record of rapid iteration and feature replication positions Meta to swiftly integrate and scale AI.

Companies like OpenAI continue to push technological boundaries, and ChatGPT has shown impressive traction. While their current incarnation may face challenges in reaching billions of daily users, I remain optimistic about their potential for significant product upgrades that could shift the landscape.

The AI race is far from over, but the current advantage lies with the giants who already dominate our digital lives. They're not just playing the game; they have home field advantage.

Thanks to Brad Gerstner, Thomas Reiner and Shreya Bhargava for their input on this article.

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future