New VC in town: “MANG”

What does the rise of MANG VC mean for entrepreneurs?

Contents:

Meet MANG (Microsoft, Amazon, Nvidia, Google)

The Demand Side: Investing in Customers

The Supply Side: Digital Tollbooths Printing Cash

What This Means for Entrepreneurs

#1 Meet MANG (Microsoft Amazon Nvidia Google)

Say hello to the newest group of prolific venture capitalists in data and AI: Microsoft, Amazon, Alphabet, and Nvidia. Total capital raised in their 2023 deals was $25B+, which is ~8% of the total venture capital raised in North America1

The MANG investments are particularly concentrated in Data and AI: their deals raised $23B, a staggering ~30% of all deals in Data and AI2. Notable 2023 investments:

#2 The Demand Side: Investing in Customers

MANG investments have evolved post the ChatGPT launch:

Before ChatGPT: Mobility startups: Waymo, Cruise, Rivian, Uber

After ChatGPT: Large Language Model (LLM) startups: OpenAI, Anthropic, Inflection, Adept, Coreweave

LLM startups are some of the largest customers of compute. It turns out that cloud providers funding their customers is a great business model. The investment capital makes a round trip back to the P&L in the form of revenue and helps them break even on the investment faster. Here’s how:

From Semafor:

“Only a fraction of Microsoft’s $10 billion investment in OpenAI has been wired to the startup, while a significant portion of the funding, divided into tranches, is in the form of cloud compute purchases instead of cash, according to people familiar with their agreement.”

Let’s assume that fraction is 50%. And let’s assume this investment will last them 2 years. That would generate $2.5b of revenue for Azure in year 1 (50% of $10b spread across 2 years). The enterprise value that creates at the median software revenue multiple of ~6x is $15b.

…

$10b EV invested for $15b EV gain in year 1 and equity in a high-potential startup.

…

$10b for $15b + equity.

…

A traditional VC would have a different equation. Simply: $10b for equity.

Setting aside Bill Gurley’s concerns around revenue recognition, these are clearly NPV-positive investments for MANG!

I expect MANG’s pace of investing for the next 24 months to stay high around ~5% of total VC $s; up from 1-2% pre-2023.

While this business model of investing in your customer is not new (Illumina has done this with their spinoffs and Palantir with their investments into customer SPACs), it does raise a set of interesting ramifications for VCs.

As MANG sets prices on these rounds (e.g. OpenAI by MSFT), what does the valuation represent?

Does it make sense for a financial investor to participate in these rounds?

For early-stage VCs, do I want my companies to raise $ from MANG?

#3 The Supply Side: Digital Tollbooths Printing Cash

The MANG businesses have evolved into modern-day digital tollbooths: earning fees from a vast number of customers. Whenever a new data or AI project launches, the cash register first rings at the hyperscaler. In fact, for every $1 of inferencing that customers pay their LLM provider (e.g. Anthropic hosted on AWS Bedrock), we estimate that >50% of that revenue goes to the hyperscaler to cover infrastructure costs + gross profit share.

The combined operating profits for MANG in 2023 were $276B3, representing ~5x growth in the last 10 years. What do you do with all this cash?

One use of this cash is capital expenditures. Their business is also capital-intensive, necessitating continuous investment in infrastructure. The combined Capex for MANG in 2023 was $108B, which grew ~12x in the last 10 years4.

By investing in infra-consuming startups, MANG can ensure the optimal utilization of their cloud services, reducing the risk around their voracious capital deployment.

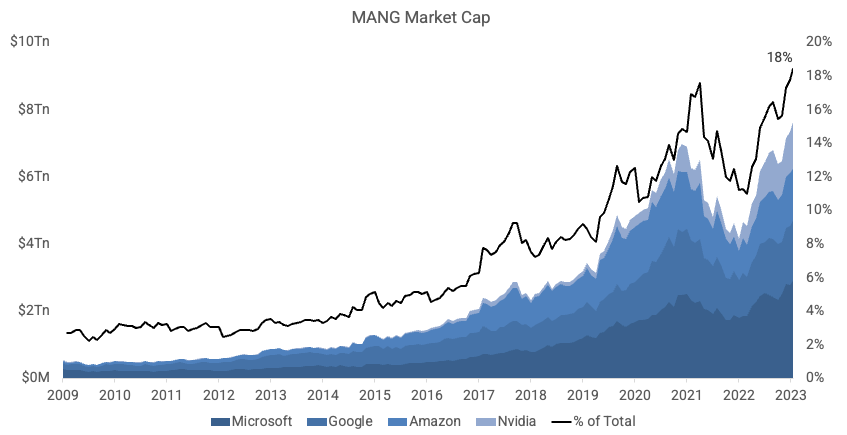

MANG now represents $7.6 trillion of combined market capitalization (18% of US market cap) today versus up 16x in the last 13 years from $480 billion (3% of US market cap) in 20105.

#4 What does this mean for entrepreneurs?

If you are an entrepreneur considering raising from MANG, there are a few tradeoffs you should consider.

Pros

Access to lower cost of capital: if you are strategically aligned with the MANG, you might be able to access large pools of lower-cost capital (vs traditional VCs). This will manifest in your fundraise as a larger total round and perhaps one with lower dilution. However, raising at a higher valuation is not always a good thing. As our friends from HBO’s Silicon Valley put it:

Shared GTM: being able to leverage MANG’s sales force would be a dream come true for most entrepreneurs. But has this worked out in practice for anyone successfully? What are the economics you need to share with MANG? What would a high concentration of revenue coming from one cloud mean for your business?

Access to models/team: getting access to state-of-the-art models, infrastructure or research could help improve your performance vs competitors, especially if the model layer is not your core competency.

Cons

Alienating customers: if you raise significant capital from any one of the MANG, you will most likely get aligned on infrastructure. In doing so, you may forego a certain set of customers who are predominantly built on the other clouds. Relatedly, having a major strategic MANG investor can be a turnoff to potential customers or business partners who view themselves as competitors to the MANG or one of their offerings. For instance, enterprises need to go via Azure OpenAI service to access OpenAI and can’t access it via GCP/AWS as of this writing

Multi-round dynamics: Do you need to raise more capital after this round? Will one of the MANGs be around for that next round? If not, what does this mean for your future rounds? What if the price set by a strategic partner cannot be matched by a financial partner?

Cap table construction: If you do aim to go public, having a large strategic investor on your cap table can create negative signaling for your stock. Ideally, your largest shareholders are investors who are known to provide steady long-duration capital, who are typically financial investors.

Misaligned incentives: MANG aren’t purely financial investors and will have strategic directives that may be misaligned with other purely financial investors. They may limit/block acquisition offers and financing rounds that would have been advantageous from a financial standpoint but didn’t align with their strategic interests.

Thanks to Brad Gerstner, Cobi B-Gantz, Sud Bhatija, Angad Singh, Govind Chandrashekar, Eric Trac, and Shreya Bhargava for their input on this article.

PitchBook analysis. Assumptions: 1) North America only 2) does not include M&A 3) $25B represents the total capital raised in deals that MANG participated in. It does not represent the capital invested in by MANG directly. 4) Includes MANG corporate VC arms, though the overwhelming majority (90%+ by capital) of this investing is done by the parent company directly

In addition to assumptions in prior footnote, this analysis filters deals tagged as “Big Data” and “AI/ML” on PitchBook.

Includes assumptions for latest quarter, in case numbers are not reported yet.

Includes assumptions for latest quarter, in case numbers are not reported yet.

Analysis normalizes GDP to market capitalization using via FRED conversion

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

I'm in the middle of listening to "Invisible Trillions," by Raymond Baker. Leaving aside his weird insistence that "Capitalism is good actually," he has a section laying out how megacorps use shell game IP licensing & internal transfer transactions to move profit around in a way that avoids ever calling it "profit" & avoids basically all taxation & regulation. Could these non-cash investments serve a similar function? Avoiding taxation/reporting/regulation?

Very much like your first chart. Do you happen to have an updated version of it?